Introduction to Wells Fargo and its Services

Wells Fargo has long been a trusted name in the financial industry. With a history that stretches back over 160 years, this banking giant offers a wide array of services tailored to meet diverse customer needs. Whether you’re looking to buy your first home, finance education, or manage unexpected expenses, Wells Fargo provides customized loan options designed for every stage of life.

Navigating the world of loans can feel overwhelming. So many choices exist! But with Wells Fargo’s extensive experience and personalized approach, achieving your financial goals becomes more accessible than ever before. Let’s dive into what makes their loan offerings unique and how they can help you find the right fit for your aspirations.

Understanding the Different Types of Loans Offered by Wells Fargo

Wells Fargo offers a variety of loan options tailored to meet diverse financial needs. Whether you’re looking for a personal loan, mortgage, or auto financing, they have you covered.

Personal loans provide flexibility. You can use them for debt consolidation, home improvements, or unexpected expenses. The straightforward application process makes it easy to access funds when you need them most.

For those dreaming of homeownership, Wells Fargo provides multiple mortgage solutions. From conventional loans to FHA and VA options, there’s something for everyone depending on your credit and down payment capabilities.

If you’re interested in purchasing a vehicle, their auto loans are worth considering too. Competitive rates and flexible terms make driving away in your dream car more attainable than ever.

Each option is designed with the borrower’s goals in mind—making it easier to choose what fits best with your financial situation.

Benefits of Choosing Wells Fargo for Your Loan Needs

Choosing Wells Fargo for your loan needs comes with a host of advantages. First, their extensive range of loan options caters to various financial situations, whether you’re looking for personal loans, home mortgages, or business financing.

The application process is user-friendly and straightforward. Customers can easily apply online or visit a local branch for personalized assistance. Their commitment to customer service means you’re never left in the dark about your application status.

Wells Fargo also offers competitive interest rates that can help save you money over time. With flexible repayment terms, borrowers can find a plan that fits their budget and lifestyle.

Additionally, they provide valuable resources like budgeting tools and educational content to empower you throughout your borrowing journey. This focus on support ensures you’re equipped to manage your finances better than ever before.

How to Apply for a Loan with Wells Fargo

Applying for a loan with Wells Fargo is a straightforward process. Start by visiting their official website, where you’ll find all the necessary information about different loan options from Wells Fargo.

Next, gather your financial documents. This typically includes income statements, tax returns, and details about any existing debts. Having these ready will streamline your application.

Once prepared, fill out the online application form or visit a local branch if you prefer face-to-face assistance. Make sure to provide accurate information to avoid delays in processing.

After submission, keep an eye on your email or phone for updates regarding your application status. Wells Fargo’s team will review your details and contact you if they need further information.

Tips for Managing Your Loan and Repayment Process

Managing your loan and repayment process requires a proactive approach. Start by creating a budget that clearly outlines your income and expenses. This will help you allocate funds for monthly payments.

Set up automatic payments if possible. This can prevent missed due dates and save you from incurring late fees. Many lenders, including Wells Fargo, offer this convenient option.

Regularly review your financial situation. If unexpected changes arise, don’t hesitate to reach out to customer service for guidance on modifying payment plans or exploring alternative options.

Keep track of interest rates as well. Refinancing may be an opportunity worth considering if rates drop significantly during your repayment period.

Maintain open communication with Wells Fargo. They provide resources and support tailored to help customers manage their loans effectively. Don’t wait until challenges arise; being proactive is key to successful loan management.

Success Stories: Real People Achieving Their Goals with Wells Fargo’s Help

Jessica, a small business owner, turned her dream into reality with a Wells Fargo loan. After struggling to secure funding elsewhere, she found the support she needed. With tailored financial solutions from Wells Fargo, she expanded her boutique and hired staff.

Then there’s Mark, who wanted to buy his first home. Navigating the mortgage process felt overwhelming. However, with guidance from Wells Fargo’s experienced team and personalized loan options, he successfully closed on his dream house just in time for summer barbeques.

Emily decided to pursue higher education but faced financial barriers. Thanks to a student loan through Wells Fargo, she now studies at her desired university and is one step closer to achieving her career goals.

These stories exemplify how customized support can empower individuals to reach their aspirations seamlessly.

Frequently Asked Questions

Navigating the world of loans can be daunting. To help you make informed decisions, here are some frequently asked questions about loan options from Wells Fargo:

What types of loans does Wells Fargo offer?

Wells Fargo provides a variety of loan options to suit different needs. These include home mortgages, personal loans, auto loans, and student loans. Each option is tailored to meet specific financial goals.

How do I know which loan is right for me?

Choosing the right loan depends on your individual circumstances. Consider factors like your credit score, income level, and what you intend to finance. A representative at Wells Fargo can guide you through this process.

What documents will I need to apply for a loan with Wells Fargo?

Typically, you’ll need identification proof (like a driver’s license), income verification (such as pay stubs or tax returns), and information about any existing debts or assets.

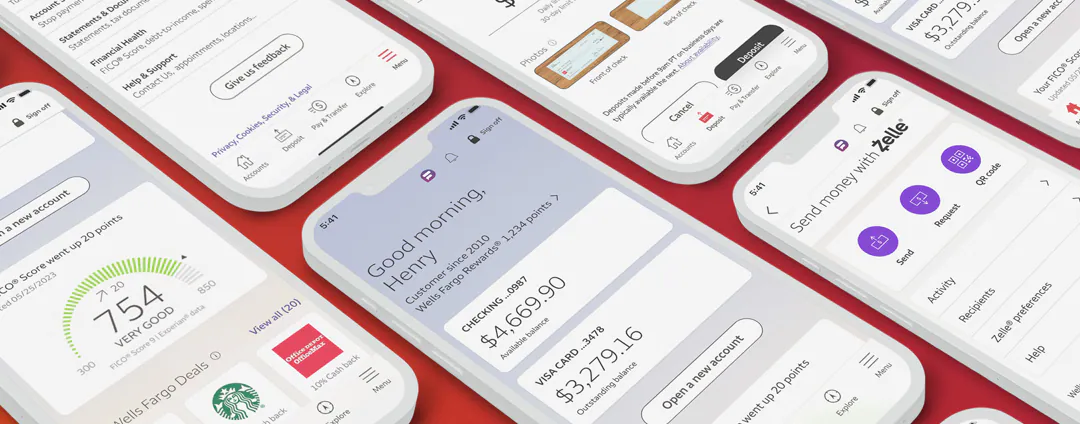

Can I manage my loan online?

Yes! Wells Fargo offers an intuitive online platform where you can view your account details, make payments, and track your progress towards repayment.

Are there any fees associated with taking out a loan from Wells Fargo?

Fees may vary depending on the type of loan and its terms. It’s advisable to discuss these upfront during the application process so that you’re fully aware before proceeding.

Wells Fargo’s diverse range of customized loan options makes it easier than ever for individuals and families to achieve their financial goals while managing their repayments efficiently.