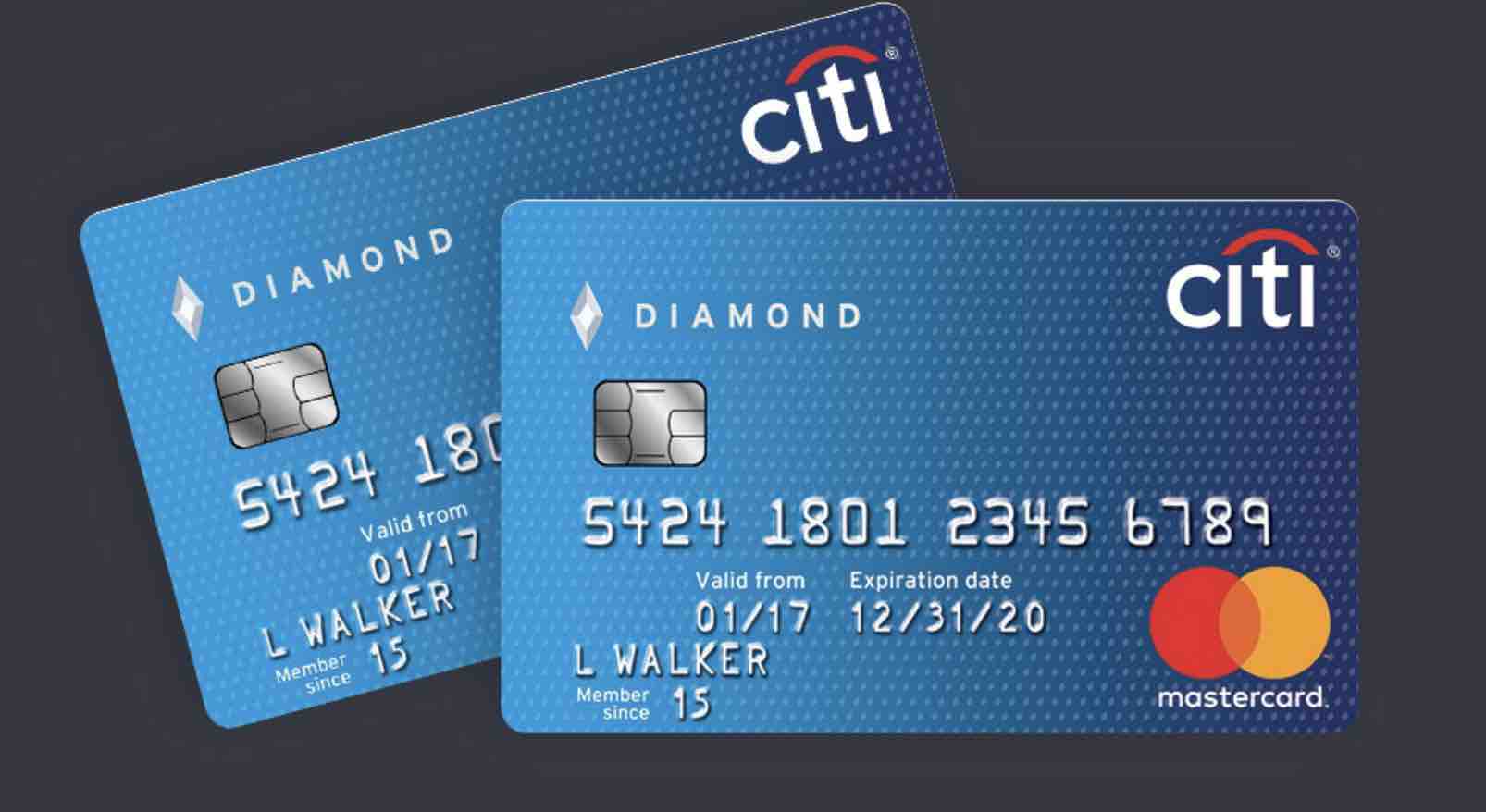

Introduction to Citi Bank Credit Card

Citi Bank Credit Cards have become a popular choice for many consumers looking to enhance their financial journey. With a range of options tailored to fit different lifestyles, these cards offer more than just purchasing power; they provide an opportunity to manage finances wisely and build wealth over time. Whether you’re planning a big purchase or simply want to earn rewards on everyday spending, understanding how to effectively use your Citi Bank Credit Card can unlock numerous benefits. Let’s delve into the world of Citi Bank Credit Cards and discover how they can be a powerful tool in your financial toolkit.

How to Apply for a Citi Bank Credit Card

Applying for a Citi Bank Credit Card is a straightforward process. Start by visiting the official Citi website or downloading their mobile app. Both platforms offer an easy-to-navigate interface.

Once there, you’ll need to choose the type of credit card that suits your needs best. Whether you’re looking for rewards, cashback, or low-interest rates, Citi has various options available.

Next, fill out the online application form with accurate personal information. This includes your employment details and financial situation. Be ready to provide documentation if required.

After submitting your application, wait for approval notification via email or through your account on their site. The whole process usually takes just a few minutes to several days depending on various factors.

Keep in mind that having good credit can significantly improve your chances of approval and may qualify you for better terms.

Benefits of Using a Citi Bank Credit Card

Using a Citi Bank Credit Card opens up a world of benefits that can enhance your financial experience. One standout feature is the diverse range of rewards programs tailored to fit various lifestyles.

Cardholders enjoy cashback on everyday purchases, making it easier to save while spending. Whether you’re filling up your gas tank or shopping for groceries, those rewards add up quickly.

Travel enthusiasts benefit immensely too. Many Citi Bank cards offer travel perks like discounts on flights and hotel bookings, helping you explore new destinations without breaking the bank.

Additionally, there are exclusive access opportunities for events and experiences that can make life more exciting. From concerts to sporting events, these cardholder-only offers elevate your social calendar effortlessly.

Security features also provide peace of mind. With fraud protection and zero liability policies in place, using your card feels safer than ever before. Enjoy smart spending with confidence through Citi Bank’s offerings!

Tips for Smart Financial Management with Your Citi Bank Credit Card

Managing your finances wisely with a Citi Bank Credit Card can lead to significant advantages. Start by setting a budget that incorporates your credit card spending. This helps you track expenses and avoid overspending.

Always pay your balance in full each month. This practice not only avoids interest charges but also reflects positively on your credit score.

Utilize alerts for due dates or spending limits to stay informed about your financial habits. These reminders can prevent late fees and keep you within budget.

Take advantage of the online tools provided by Citi Bank, which allow you to monitor transactions easily and analyze spending patterns. Understanding where your money goes is crucial for better management.

Utilize rewards strategically. Whether it’s cashback or travel points, align them with purchases you already make rather than changing habits solely for rewards.

Maximizing Rewards and Cashback Offers

To make the most of your Citi Bank Credit Card, understanding the rewards structure is crucial. Each card offers different perks—whether it’s travel points or cashback on everyday purchases. Familiarize yourself with what your card provides.

Take advantage of promotional periods when bonus rewards are offered. These limited-time opportunities can significantly boost your earnings. Sign up for notifications to stay updated on these special events.

Make strategic decisions about where you shop. Certain categories may yield higher cashback rates, such as groceries or gas stations. Using your card wisely means shopping consciously.

Also, consider using online portals linked to your Citi Bank account for additional cashback rewards when you shop online. Small adjustments in habits can lead to substantial benefits over time.

Remember that paying off balances promptly ensures that those hard-earned rewards don’t get offset by interest charges!

Managing Debt and Building Credit Score with Your Citi Bank Credit Card

Managing debt effectively is crucial for financial stability. Using your Citi Bank credit card wisely can help you stay on track.

Start by making timely payments. Set up alerts or automatic payments to avoid missed deadlines. This habit will not only prevent late fees but also enhance your credit score over time.

Keep your spending within limits. Aim to use no more than 30% of your available credit. This practice shows lenders that you can manage credit responsibly, further boosting your score.

Regularly check your statements and monitor transactions closely. Spotting errors quickly allows you to address them without damaging your finances.

Additionally, consider using the card for essential purchases only and pay off the balance each month. This strategy helps build a positive payment history while keeping debt at bay.

Frequently Asked Questions about Citi Bank Credit Cards

When considering a Citi Bank Credit Card, many questions arise. One common inquiry revolves around eligibility. Most applicants need to be at least 18 years old and have a steady income.

Another frequent concern is the rewards structure. Customers often wonder how points are earned and redeemed. Each card has unique benefits tailored for different spending habits, making it essential to review options carefully.

Fees also draw attention. Many users ask about annual fees or foreign transaction charges before applying for a card. Awareness of these costs can help in selecting the right one.

Cardholders frequently seek information on customer support availability. Knowing when and how to reach out for assistance can enhance the overall experience with your credit card provider.

Frequently Asked Questions

Navigating the world of credit cards can be overwhelming, especially when you’re trying to make the most out of your Citi Bank Credit Card. Here are some common questions that might help clarify any uncertainties you have.

What types of Citi Bank Credit Cards are available?

Citi offers a variety of credit cards tailored to different needs. Whether you’re looking for cashback rewards, travel benefits, or balance transfer options, there’s likely a card for you.

How do I check my Citi Bank Credit Card application status?

You can easily check your application status online through the Citi website. Simply log in to your account and follow the prompts provided.

Are there any annual fees associated with Citi Bank Credit Cards?

Some Citi credit cards come with no annual fee while others may charge one depending on their features and rewards programs. Always read the terms carefully before applying.

Can I earn points or cashback on all purchases made with my card?

Most purchases qualify for points or cashback; however, certain categories like groceries or gas may offer increased rewards rates. It’s wise to familiarize yourself with these details to maximize earnings.

What should I do if my card is lost or stolen?

If your card is lost or stolen, contact customer service immediately. They will assist you in reporting it and will issue a replacement card quickly.

Understanding these aspects can enhance your experience as a Citi Bank Credit Card user. By keeping informed and proactive about managing your finances wisely, you’ll unlock even more benefits from this valuable financial tool.

For more informations: https://www.citi.com/