Introduction to Citi Bank

When it comes to managing your finances, flexibility is key. Citi Bank understands this need and offers a range of loan options designed to fit various financial situations. Whether you’re planning a major purchase, consolidating debt, or funding a personal project, Citi Bank Loans can provide the support you need. With competitive rates and tailored solutions, navigating your financial journey becomes much simpler. Let’s explore how Citi Bank can unlock the doors to new opportunities for you!

Types of Loans Offered by Citi Bank

Citi Bank offers a diverse array of loan options tailored to meet various financial needs. Whether you’re looking for personal growth or home improvement, there’s something for everyone.

Personal loans provide flexibility, allowing you to use funds as you see fit. These loans can be ideal for consolidating debt or covering unexpected expenses.

For those aiming to purchase a home, Citi’s mortgage solutions are comprehensive and competitive. They offer fixed-rate and adjustable-rate mortgages that suit different budgets and preferences.

If education is your goal, Citi Bank also provides student loans with favorable terms designed to help alleviate the burden of tuition costs.

Small businesses can benefit from Citi’s business loans too, offering funding options that promote growth and sustainability in today’s dynamic market. Each product is crafted with customer-centric features aimed at enhancing financial well-being.

Benefits of Taking Out a Loan with Citi Bank

Taking out a loan with Citi Bank comes with several compelling benefits. First, their competitive interest rates can help you save money over the life of your loan.

Citi Bank offers flexible repayment terms that cater to your financial situation. You can choose a plan that aligns best with your budget and cash flow.

Customer service is another standout feature. Their dedicated support team is available to assist you throughout the application process and beyond.

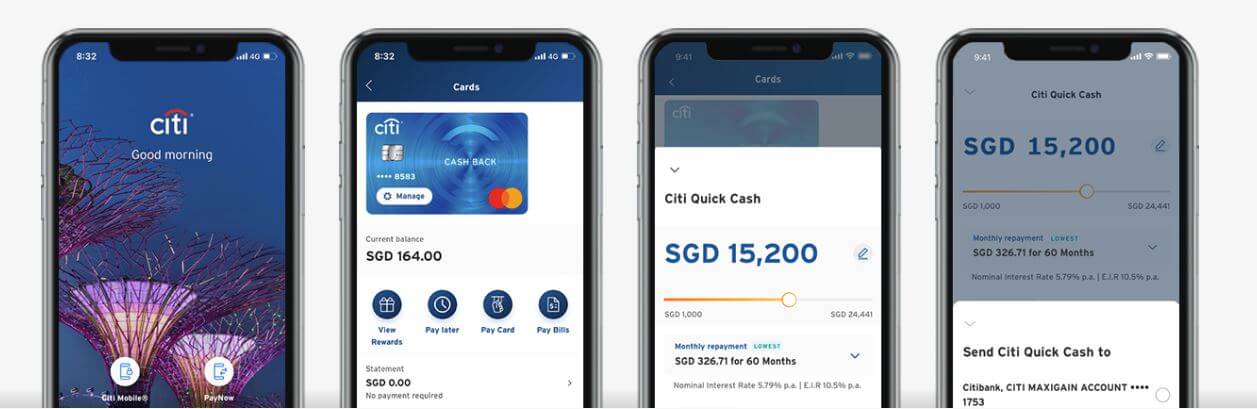

Moreover, Citi Bank provides easy online account management tools. Monitoring your balance and making payments becomes hassle-free.

Also worth mentioning is the potential for additional perks like rewards or discounts on future borrowing. This adds extra value as you manage your finances effectively while enjoying flexibility in repayments.

Eligibility Requirements and Application Process

Citi Bank Loans come with specific eligibility requirements that applicants should be aware of. First, you need to be at least 18 years old and a U.

S. citizen or permanent resident. This ensures that you’re legally able to enter into a loan agreement.

Next, Citi Bank considers your credit score during the application process. A strong credit history can improve your chances of approval and may even help secure better interest rates.

The application itself is straightforward. You can start online by filling out an easy-to-navigate form. Be prepared to provide personal details, income information, and any outstanding debts.

Once you submit your application, Citi Bank typically reviews it quickly and communicates their decision within days. If approved, you’ll receive clear instructions on the next steps for accessing your funds efficiently.

Tips for Managing and Paying Off Your Loan

Managing and paying off your loan effectively can make a significant difference in your financial health. Start by creating a budget that clearly outlines your monthly expenses, including your loan payment. This will help you prioritize and allocate funds appropriately.

Consider setting up automatic payments to ensure you never miss a due date. Consistent, timely payments can also boost your credit score over time.

If possible, pay more than the minimum each month. Extra payments reduce the principal balance faster, saving on interest costs.

Stay informed about any fees or penalties associated with early repayment so you’re not caught off guard later.

Don’t hesitate to communicate with Citi Bank if you face difficulties managing repayments. They may offer options like refinancing or restructuring terms tailored to your situation.

Customer Reviews and Success Stories

Citi Bank Loans have garnered a range of customer experiences that highlight their flexibility and reliability. Many borrowers appreciate the easy online application process, often completing it in just minutes.

One success story features a family who needed funds for unexpected medical expenses. They found Citi Bank’s personal loan options to be quick and stress-free, allowing them to focus on what mattered most—getting back on their feet.

Another satisfied customer shared how they secured a home improvement loan through Citi Bank. This enabled them to renovate their kitchen without breaking the bank or dipping into savings.

These testimonials reveal not only satisfaction but also peace of mind among clients trusting Citi Bank with their financial needs. The diverse lending solutions cater effectively to various situations, making it clear why many choose this institution as their go-to for loans.

Alternatives to Citi Bank Loans

When considering financing options beyond Citi Bank loans, several alternatives come to mind. Credit unions often provide lower interest rates and more personalized service. Their member-focused approach can lead to better loan terms.

Online lenders are another viable option. They offer quick applications and fast funding decisions. Many specialize in personal loans for different credit profiles, making them accessible for a wider audience.

Peer-to-peer lending platforms connect borrowers directly with investors. This method can yield competitive rates while bypassing traditional banks altogether.

Consider borrowing from family or friends if you’re comfortable doing so. This informal route may result in flexible repayment terms without the pressure of high-interest payments commonly associated with formal loans. Each of these alternatives presents unique benefits worth exploring based on your financial needs and circumstances.

Frequently Asked Questions

Citi Bank Loans offer a range of options that can help you achieve your financial goals. Whether you’re looking to consolidate debt, finance a major purchase, or cover unexpected expenses, Citi Bank has solutions tailored for various needs.

Here are some common questions related to Citi Bank loans:

What types of loans does Citi Bank offer?

Citi Bank provides personal loans, home equity lines of credit (HELOCs), and auto financing among other options.

How do I apply for a loan with Citi Bank?

You can easily apply online through their website or visit a local branch. Be prepared with necessary documentation such as income verification and credit history.

What is the typical interest rate for Citi Bank Loans?

Interest rates vary based on the type of loan and your credit profile. It’s best to check current rates directly on their website or speak with a representative.

Are there any fees associated with taking out a loan from Citi Bank?

While some loans may have origination fees or prepayment penalties, many do not. Always read the fine print before signing anything.

Can I pay off my loan early without penalties?

Many borrowers prefer this flexibility. However, it’s important to confirm whether your specific loan agreement allows early repayment without incurring additional charges.

Do I need good credit to qualify for a loan at Citi Bank?

While having good credit improves your chances of approval and gets you better rates, they also consider various factors in their decision-making process.

By answering these FAQs and considering what choices fit best into your financial life, you’ll be well-equipped to take advantage of everything that comes with using Citibank’s lending services!