Introduction: The Importance of Choosing the Right Credit Card

Choosing the right credit card is a crucial decision that can significantly impact your financial life. With so many options out there, it’s easy to feel overwhelmed. You want a card that not only fits your spending habits but also offers perks and rewards tailored just for you. Enter Citi Bank—a name synonymous with innovative banking solutions and customer satisfaction. Citi’s credit card offer stands out in this crowded market, providing users with benefits that go beyond simple transactions.

Whether you’re looking for cash back on everyday purchases or travel rewards to fuel your wanderlust, understanding what Citi has to offer can make all the difference in maximizing your financial potential. Let’s dive into the world of Citi’s credit cards and uncover the unique advantages they bring!

What Makes Citi Bank Stand Out?

Citi Bank stands out in the crowded financial landscape for several reasons.

First, its global presence is impressive. With branches and ATMs worldwide, Citi provides seamless access to your finances no matter where you are.

Second, their technology is top-notch. The mobile app offers user-friendly features that make managing accounts easy and efficient.

Additionally, customer service goes beyond expectations. Representatives are available around the clock to assist with inquiries or concerns.

Citi also emphasizes security with advanced fraud protection measures, ensuring peace of mind for cardholders.

Moreover, Citi’s credit card rewards system is particularly attractive, offering competitive cashback and travel benefits tailored to various lifestyles and spending habits.

With a focus on innovation and customer satisfaction, Citi Bank consistently delivers value that makes it a smart choice for many consumers looking for a reliable banking partner.

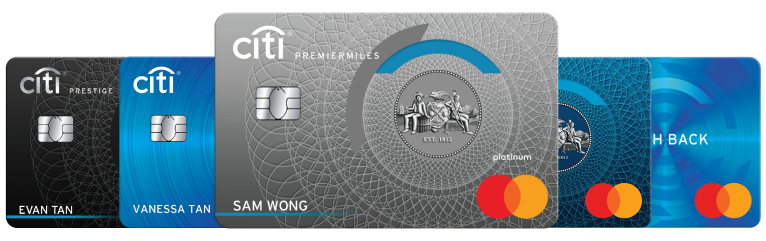

Types of Citi Credit Cards and Their Benefits

Citi Bank offers a diverse range of credit cards tailored to fit different lifestyles and spending habits. Whether you’re a frequent traveler or someone who enjoys rewards for everyday purchases, there’s likely a card that suits your needs.

The Citi Double Cash Card is popular for its straightforward cashback program. You earn 1% on every purchase and an additional 1% when you pay off those purchases. This makes it easy to rack up cash without complex categories.

For travel enthusiasts, the Citi Premier® Card stands out with its competitive points system that can be redeemed for flights, hotels, and more. Plus, it often comes with bonuses after meeting specific spending thresholds.

If you’re looking for balance transfer options, the Citi Simplicity® Card excels in offering no late fees and long promotional periods on transferred balances. Each card presents unique advantages designed to enhance your financial journey while maximizing benefits based on personal preferences.

How to Apply for a Citi Credit Card

Applying for a Citi credit card is straightforward and user-friendly. First, head over to the official Citi website or visit your nearest branch.

You’ll need to choose a card that fits your lifestyle—there are options tailored for travel rewards, cash back, and more. Each card comes with unique perks worth considering.

Once you’ve selected your desired card, gather necessary information like personal details, income level, and employment status. Having these ready will streamline the application process.

Fill out the online form accurately. Double-check all entries before submitting to avoid any delays in processing.

After submission, you’ll receive confirmation of your application status fairly quickly. If approved, expect your new credit card in the mail soon after!

Managing Your Citi Credit Card Account

Managing your Citi credit card account is straightforward and user-friendly. With online banking, you can monitor transactions in real-time. This feature ensures you stay informed about every charge made.

The mobile app adds another layer of convenience. You can pay bills, check rewards points, and track spending habits with just a few taps. Notifications keep you updated on due dates and special offers as well.

Setting up automatic payments also provides peace of mind. You’ll never miss a payment, which helps maintain a healthy credit score.

Furthermore, Citi’s budgeting tools help you plan for the future. Visualize your spending trends to make smarter financial choices.

For any issues or questions, customer support is readily available through various channels—phone, chat, or secure messaging within the app. All these features are designed to enhance your experience and ensure that managing finances remains hassle-free.

Special Offers and Rewards for Citi Credit Card Holders

Citi credit card holders are in for a treat with an array of special offers and rewards. These incentives can significantly enhance your spending experience.

Many Citi cards come equipped with cashback options that allow users to earn a percentage back on everyday purchases. This means every coffee, grocery run, or online shopping spree translates into savings.

Beyond cash back, travel enthusiasts will appreciate the airline miles and hotel points available through select cards. Accumulating these rewards can lead to free flights or luxurious stays at premium hotels.

Moreover, Citi often partners with various retailers for exclusive discounts. Whether it’s dining out or online shopping, cardholders frequently enjoy limited-time promotions that add value to their transactions.

Stay updated on seasonal offers as Citi regularly refreshes its benefits, ensuring that you’re always getting the most from your wallet!

Frequently Asked Questions

Choosing a credit card is no small task. With so many options available, knowing what to look for can make all the difference. Citi’s Credit Card Offer provides various benefits tailored to fit diverse financial needs and lifestyles.

When considering your options, you might find yourself with some questions. Here are answers to some common queries about Citi’s credit cards:

What types of rewards can I earn with Citi’s credit cards?

Citi offers a variety of reward structures depending on the card type—ranging from cashback on everyday purchases to travel points that can be redeemed for flights and hotel stays.

Are there annual fees associated with Citi credit cards?

Some Citi credit cards do come with annual fees, while others offer fee-free options. It’s essential to review each card’s terms before applying.

How do I know which Citi credit card is right for me?

Consider your spending habits and preferences. If you frequently travel, a card offering travel rewards may suit you best; if shopping is your priority, explore cashback options.

Can I manage my account online?

Absolutely! Citibank provides an intuitive mobile app and website where you can track expenses, pay bills, and monitor rewards easily.

Is customer service readily available if I have issues or questions?

Yes! Citibank has dedicated customer support representatives who are ready to assist whenever needed.

With such comprehensive offerings in its portfolio of credit products, it’s clear why so many people choose Citi Bank as their go-to option for managing finances effectively.

For more informaitons: https://www.citi.com/