Introduction to Bank of America and Personal Loans

When it comes to achieving your financial goals, the right support can make all the difference. Whether you’re planning a home renovation, consolidating debt, or funding a dream vacation, personal loans can provide you with the necessary funds to take that leap. Bank of America stands out as an excellent option for those seeking reliable and flexible lending solutions. With a strong reputation in the banking industry, they offer personalized services tailored to meet individual needs. Interested in discovering how loans from Bank of America can empower your future? Let’s dive into what makes their personal loan offerings so appealing and how they can help transform your aspirations into reality!

Benefits of Personal Loans from Bank of America

When considering personal loans, Bank of America stands out for several reasons. One key benefit is competitive interest rates. These rates can save you money over the life of your loan.

Flexibility is another strong point. Borrowers can choose amounts ranging from a few thousand to tens of thousands, making it easy to find the right fit for your needs.

Additionally, Bank of America offers quick funding options. You could receive funds as soon as the same day after approval, providing timely access when you need it most.

Moreover, their user-friendly online platform simplifies managing your loan and payments. This convenience allows you to focus on what matters most in achieving your goals.

Dedicated customer support ensures that help is available whenever questions arise throughout the borrowing process.

Types of Personal Loans Offered by Bank of America

Bank of America offers a variety of personal loans tailored to meet diverse financial needs. One popular option is the unsecured personal loan, which allows borrowers to access funds without putting up collateral. This provides flexibility for expenses like home renovations or medical bills.

For those looking to consolidate debt, Bank of America’s debt consolidation loans can simplify finances by combining multiple debts into one manageable payment. This often helps reduce monthly payments and interest rates.

If you have an unexpected expense, such as car repairs or travel emergencies, quick cash loans might be the way to go. These short-term solutions are designed for urgent financial situations.

Additionally, Bank of America provides options for customized loan amounts and repayment terms. This adaptability ensures that each borrower finds a plan that aligns with their unique circumstances and future goals.

How to Apply for a Personal Loan with Bank of America

Applying for a personal loan with Bank of America is straightforward. Start by visiting their website or your local branch to explore the options available.

Next, gather your financial information. This includes details about your income, employment history, and any existing debts. Being prepared can speed up the application process.

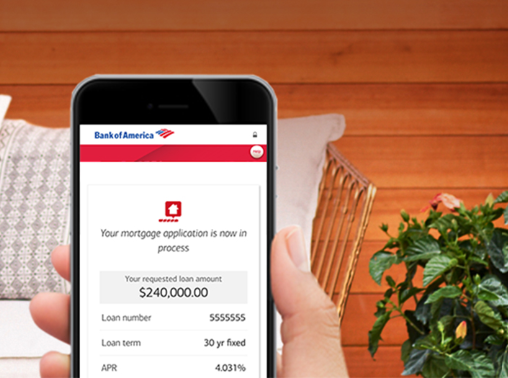

Once you have everything ready, fill out the online application form or speak directly with a banker at a branch. Be honest and thorough in providing all necessary information.

After submission, Bank of America will review your application and conduct a credit check. You may receive an offer quickly through email or phone call.

If approved, carefully review the terms before accepting the loan. Make sure you understand interest rates and repayment schedules to avoid surprises later on.

Tips for Using a Personal Loan Responsibly

Using a personal loan wisely is crucial for your financial health. Start by assessing your needs. Only borrow what you can repay comfortably.

Create a budget to manage your expenses. This helps you allocate funds for monthly payments without stretching your finances too thin.

Consider setting up automatic payments to avoid missed deadlines. Timely repayments improve your credit score, making future borrowing easier.

Avoid using the loan for unnecessary purchases or lifestyle upgrades. Focus on essential expenses like medical bills or home repairs instead.

Stay informed about interest rates and terms to ensure you’re getting the best deal available. Understanding these factors empowers smarter decision-making in the long run.

Keep communication open with lenders if challenges arise in repayment. They may offer solutions that help you navigate tough times more effectively.

Case Study: Real Life Success Story with a Bank of America Personal Loan

Meet Sarah, a single mother of two who faced unexpected home repairs. Her roof was leaking, and the costs were beyond her budget. With limited savings, she turned to personal loans from Bank of America.

Within days, she applied online and received approval for a loan that fit her needs perfectly. The process was smooth and straightforward.

Using the funds from her personal loan, Sarah not only repaired her roof but also made some much-needed updates to ensure safety for her children.

With manageable monthly payments set at a fixed rate, she felt relief instead of stress as she tackled these changes in her life.

Sarah’s story showcases how loans from Bank of America can empower individuals to overcome financial hurdles while maintaining peace of mind during tough times.

Frequently Asked Questions

When considering loans from Bank of America, you might have some questions. Here are answers to common inquiries.

What types of personal loans does Bank of America offer?

Bank of America provides various personal loan options tailored to your needs. These include debt consolidation loans, home improvement loans, and general-purpose personal loans.

How much can I borrow with a personal loan from Bank of America?

The amount you can borrow typically ranges from $1,000 up to $100,000. Your creditworthiness plays a significant role in determining the exact figure.

What is the repayment term for these loans?

Repayment terms vary depending on the type and size of the loan but generally range between two to seven years.

Are there any fees associated with taking out a personal loan?

While Bank of America doesn’t charge an origination fee for its personal loans, late payment fees may apply if you miss a due date. Always read the fine print before applying.

How long does it take to receive funds after approval?

Once approved, most borrowers receive their funds within one business day through direct deposit or check delivery.

Can I use my personal loan for anything I want?

Yes! Personal loans offer flexibility that allows you to use them for almost any purpose—be it consolidating debt or funding big purchases like vacations or weddings.

Is my credit score affected by applying for a loan at Bank of America?

Submitting an application will initiate a hard inquiry on your credit report which could temporarily impact your score. However, responsible repayment can boost your score over time.

These insights should help clarify what you need when considering bank financing through Loans from Bank of America! The right choice can set you on track toward achieving financial goals with ease and confidence.