Introduction to Bank of America and personal loans

Bank of America has long been a trusted name in the financial world, helping countless individuals and families achieve their goals. One of the ways they do this is through personal loans, a flexible solution for those looking to manage expenses or invest in opportunities. Whether you want to consolidate debt, cover unexpected medical bills, or fund a home renovation, loans from Bank of America can provide the support you need.

With competitive rates and a straightforward application process, unlocking your financial potential has never been easier. Let’s dive into why choosing Bank of America for your personal loan could be one of the best decisions you make.

Advantages of getting a personal loan from Bank of America

Choosing a personal loan from Bank of America comes with several compelling advantages. For starters, their competitive interest rates can save you money over the life of your loan. This makes it easier to manage monthly payments.

Another key benefit is the flexible repayment terms. You can select a schedule that fits your financial situation, whether you prefer a shorter or longer term. This flexibility allows you to tailor payments according to your budget.

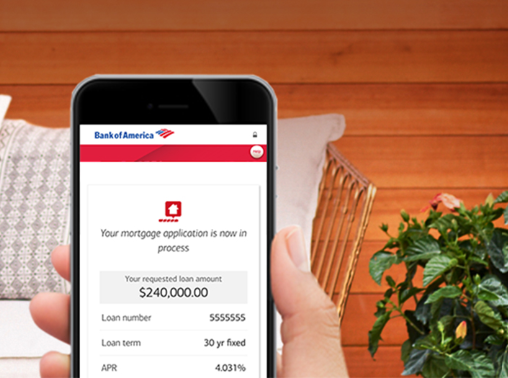

Bank of America also boasts an easy online application process. With just a few clicks, you can check rates and explore options without stepping foot in a branch.

Furthermore, existing customers may enjoy additional perks such as loyalty discounts or streamlined services through their online banking platform. These conveniences enhance the overall borrowing experience while keeping everything within reach at all times.

Different types of personal loans offered by Bank of America

Bank of America offers a variety of personal loans tailored to meet diverse financial needs. One popular option is the unsecured personal loan, which allows borrowers to access funds without putting up collateral. This type is ideal for those looking to consolidate debt or fund unexpected expenses.

For home improvements, Bank of America provides specialized loans designed specifically for renovation projects. These can help homeowners enhance their properties while adding value in the long run.

Additionally, there are options for students seeking financial assistance with education costs. The student loan program caters to individuals investing in their future through higher education.

Each loan type comes with flexible terms and competitive interest rates, making it easier than ever for customers to find the perfect fit for their unique situations. With various choices available, potential borrowers have ample opportunities to explore funding options that align with their objectives and lifestyle.

The application process for a personal loan at Bank of America

Applying for a personal loan at Bank of America is designed to be straightforward. Start by visiting their website or using the mobile app. You’ll find an easy-to-navigate interface that guides you through the application process.

Gather necessary documents like proof of income, employment information, and identification before starting your application. Having these ready will make things smoother.

Once you’ve filled out the online form, you’ll submit it for review. The bank typically provides feedback quickly, allowing you to know if you’re approved without long waits.

If approved, carefully review your loan terms. This includes interest rates and repayment schedules—all vital details that influence your financial planning.

Once everything looks good to you, accept the offer and receive your funds directly into your account shortly after approval. Simple as that!

Tips for managing and paying off your personal loan from Bank of America

Managing your personal loan from Bank of America effectively can ease financial stress. Start by creating a budget that includes your monthly loan payment. This helps you prioritize expenses and avoid surprises.

Consider setting up automatic payments to ensure you never miss a due date. This not only keeps your credit score intact but may also save you money on interest over time.

If possible, make extra payments when funds allow. Even small additional amounts can significantly reduce the principal balance, leading to less interest paid overall.

Keep track of your remaining balance and progress. Celebrating milestones, like paying off a certain percentage, can motivate you to stay on track.

Communicate with Bank of America if you’re facing difficulties. They might offer options or solutions tailored to help manage your repayment plan more effectively.

Comparison with other banks and financial institutions

When exploring loans from Bank of America, it’s essential to compare it with other banks and financial institutions. Many lenders offer personal loans, but the terms can vary significantly.

Bank of America typically provides competitive interest rates and flexible repayment options. This flexibility often sets them apart from credit unions or smaller banks that might impose stricter criteria for approval.

Moreover, their online platform simplifies loan management. Borrowers can easily keep track of payments and access customer support whenever needed.

In contrast, some alternative lenders may promise faster approvals but could have higher fees or less favorable terms. It’s crucial to weigh these factors carefully before making a decision.

Additionally, consider loyalty benefits offered by Bank of America for existing customers which may not be available elsewhere. Such perks might enhance your overall borrowing experience significantly.

Frequently Asked Questions

Navigating the world of personal loans can be overwhelming. To help you make informed decisions, here are some frequently asked questions regarding loans from Bank of America.

What types of personal loans does Bank of America offer?

Bank of America provides a variety of personal loan options including unsecured personal loans for debt consolidation, home improvements, or major purchases. They also have tailored solutions that cater to specific financial needs.

How much can I borrow with a personal loan from Bank of America?

Loan amounts typically range from $1,000 to $50,000 depending on your creditworthiness and financial profile. It’s essential to assess how much you need before applying.

What is the interest rate for a personal loan at Bank of America?

Interest rates vary based on factors like your credit score and overall financial history. On average, borrowers may see rates between 6% to 36%. It’s wise to check current rates directly through their website or by contacting customer service.

How long does it take to get approved for a loan?

The approval process can often be completed in as little as one business day after submitting all required documentation. However, this timeframe may vary based on individual circumstances and application volume.

Can I repay my loan early without penalty?

Yes! One notable advantage when securing loans from Bank of America is that they do not charge prepayment penalties if you pay off your loan early—allowing you more flexibility in managing your finances.

Is there any way I can improve my chances of getting approved?

To enhance your probability of approval, consider checking and improving your credit score prior to applying. Additionally, providing accurate information about income and existing debts will support your case during the evaluation process.

Understanding these facets will empower you as you explore personal financing options with confidence at Bank of America. Making well-informed choices today sets the stage for unlocking greater financial potential tomorrow.